Office Hours

M-F 9:00 AM - 5:00 PM EST

Our Location

Spring, Texas, 77388

Call Us Now

(470) 610-5710

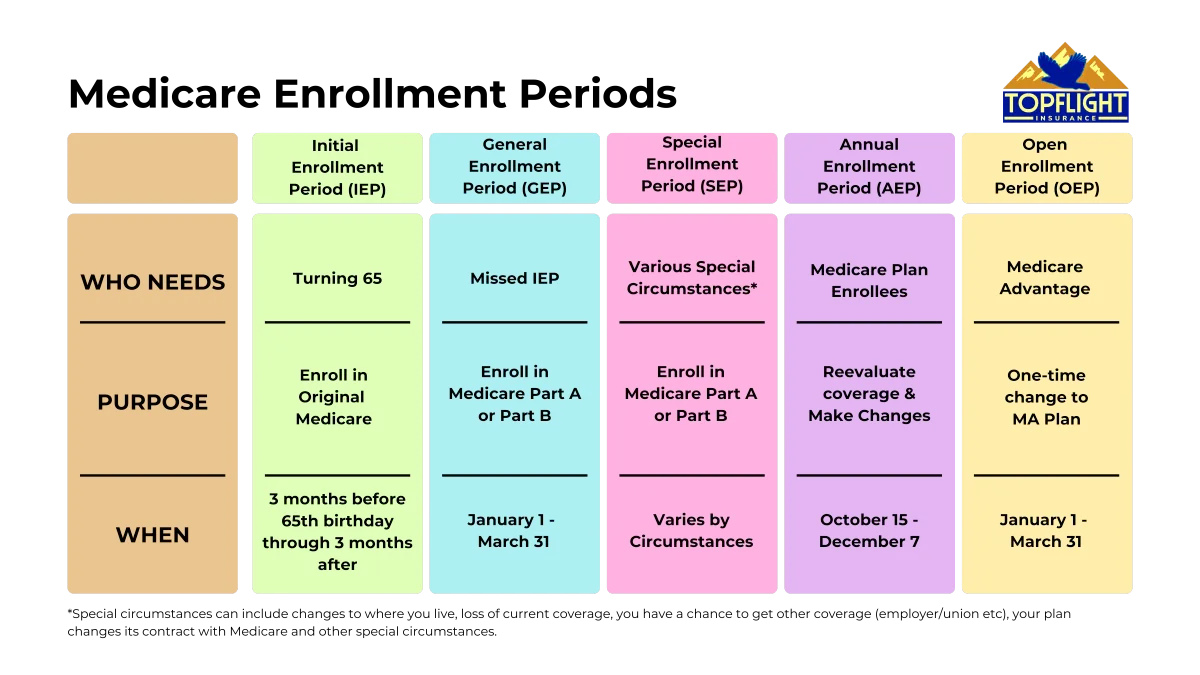

MEDICARE ENROLLMENT PERIODS

During designated Medicare enrollment periods, you have the opportunity to enroll in a Medicare plan, change your current plan, or drop a plan altogether.

Understanding these periods is essential for both new and existing Medicare enrollees, as they help you avoid late enrollment penalties and ensure you maintain continuous coverage

The Initial Enrollment Period (IEP) is your first opportunity to enroll in Medicare. It begins three months before your 65th birthday and lasts for a total of seven months, ending three months after you turn 65.

During this time, you can sign up for Medicare Part A and Part B (Original Medicare). If you're receiving Social Security Disability benefits or qualify for automatic enrollment, you may not need to enroll manually.

However, if you are not automatically enrolled and don’t sign up during this period, you could face permanent late enrollment penalties, especially if you don't have creditable coverage in place.

Initial Enrollment Period

General Enrollment Period

The General Enrollment Period (GEP) is the second opportunity to enroll in Medicare if you missed your Initial Enrollment Period (IEP) or delayed signing up. The GEP takes place each year from January 1 to March 31.

If you enroll during this time, your Medicare coverage will not begin until July 1, potentially leaving you with a coverage gap. If you don't qualify for a Special Enrollment Period, the GEP may be your only chance to enroll in Original Medicare outside of your IEP.

Keep in mind that enrolling during the GEP usually means you’ll face a late enrollment penalty, which could result in higher premiums.

The Medigap Open Enrollment Period allows you to enroll in a Medicare Supplement (Medigap) plan once you are enrolled in Original Medicare and are 65 or older. This period gives you a six-month guaranteed issue right to sign up for a Medigap plan without the risk of being denied coverage or facing higher premiums due to your medical history.

However, if you miss this window, insurers may have the right to deny coverage or charge higher rates based on your health condition

Medigap Open Enrollment Period

Annual Enrollment Period

The Medicare Annual Enrollment Period (AEP) runs from October 15 to December 7 each year. During this time, current Medicare enrollees can make important changes to their coverage, such as:

Enrolling in, dropping, or switching Part D prescription drug plans

Enrolling in, dropping, or switching Part C (Medicare Advantage) plans

Switching from a Part C plan back to Original Medicare, or vice versa

This period gives you the flexibility to adjust your Medicare coverage based on your evolving healthcare needs.

The Special Enrollment Period (SEP) allows you to enroll in Medicare without facing late enrollment penalties if you delayed your initial enrollment due to certain qualifying circumstances. For instance, you may qualify for an SEP if you had creditable coverage during your initial enrollment period but have since lost that coverage. You can also qualify if you’ve moved outside of your plan’s service area and need new coverage.

At Topflight Insurance Solutions, we’ll guide you through the various Medicare enrollment periods, helping you avoid late enrollment penalties and secure the coverage that fits your needs. Ready to get started? Contact us!

Special Enrollment Period

Frequently Asked Questions

New to Medicare?

What is Medicare and How Do I Qualify?

Medicare Advantage plans are offered by private insurance companies contracted through Medicare as an alternative to Original Medicare. These plans combine all of the benefits of Medicare Part A (hospital) and Part B (medical), and may also include prescription drug coverage, if they are Medicare Advantage Prescription Drug Plans.These plans combine all of the benefits of Medicare Part A (hospital) and Part B (medical), and may also include prescription drug coverage, dental or vision coverage all for an affordable and sometimes $0 monthly plan premium.

What is Medicare Advantage (Part C)?

Medicare Advantage plans are offered by private insurance companies contracted through Medicare as an alternative to Original Medicare. These plans combine all of the benefits of Medicare Part A (hospital) and Part B (medical), and may also include prescription drug coverage, if they are Medicare Advantage Prescription Drug Plans. These plans combine all of the benefits of Medicare Part A (hospital) and Part B (medical), and may also include prescription drug coverage, dental or vision coverage all for an affordable and sometimes $0 monthly plan premium.

What are Medicare Prescription Drug Plans (Part D)?

Medicare Part D plans add prescription drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service (PFFS) Plans, and Medicare Medical Savings Account (MSA) Plans. A prescription drug plan may help you save money on existing prescriptions or on medication needs in the future.

Not affiliated with the United States government or federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

© 2022 Topflight Insurance Solutions LLC - All Rights Reserved