Office Hours

M-F 9:00 AM - 5:00 PM EST

Our Location

Spring, Texas, 77388

Call Us Now

(470) 610-5710

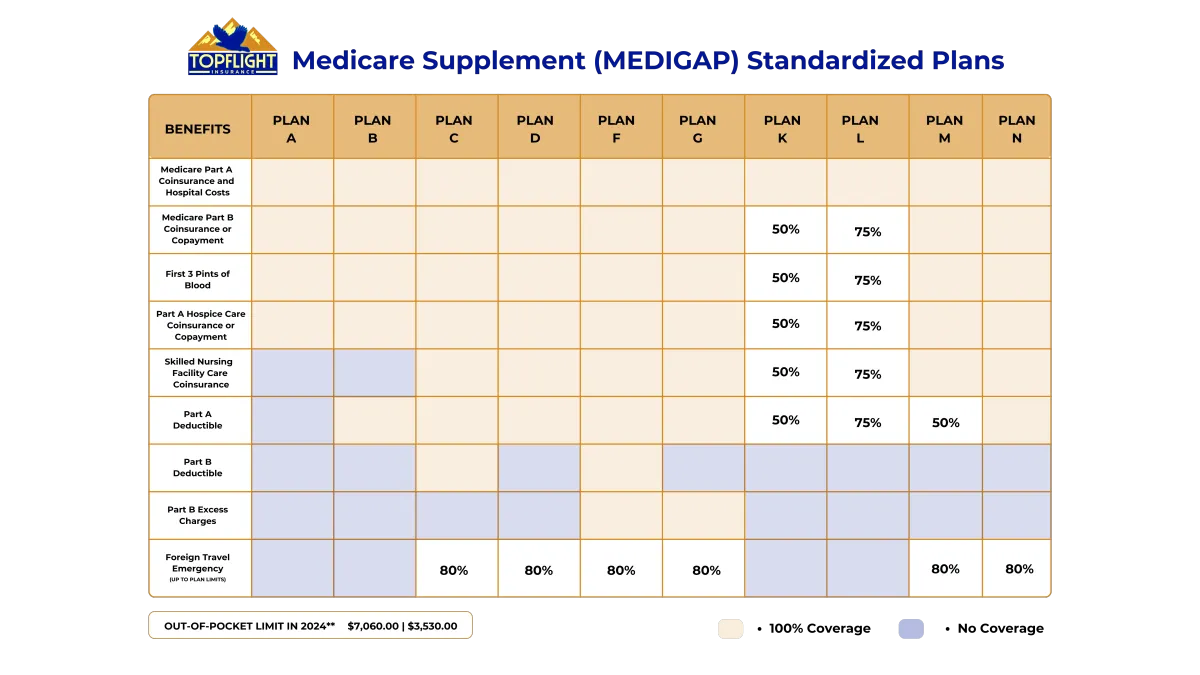

MEDICARE SUPPLEMENT PLAN COMPARISON

Medicare Supplement insurance plans, or Medigap plans, help cover out-of-pocket costs associated with Original Medicare (Parts A and B). These costs include deductibles, coinsurance, copayments, and excess charges. Some Medigap plans may also offer limited coverage for emergency medical services while traveling outside the U.S.

Over 10 million Medicare beneficiaries rely on Medigap plans to protect themselves from significant out-of-pocket medical expenses.

Medicare Supplement Plan A, a basic Medigap plan, covers a portion of the costs for outpatient medical services that Original Medicare doesn't fully cover. It also helps pay for Medicare Part B coinsurance and the first three pints of blood per year.

While Plan A is widely available, it may not be the best choice for many individuals. We often recommend exploring more comprehensive plans like Plan F, Plan G, or Plan N.

Medigap Plan A

Medigap Plan B

Medicare Supplement Plan B offers similar coverage to Plan A, but with the added benefit of covering the Medicare Part A hospital deductible. This can be significant, as the Part A deductible is not an annual amount and can be incurred multiple times throughout the year.

Medicare Supplement Plan C provides comprehensive coverage for most of the out-of-pocket costs associated with Original Medicare. This includes copayments, coinsurance, and other expenses. However, it may not cover excess charges for Medicare Part B services, depending on your state's regulations.

Medigap Plan C

Medigap Plan D

Medicare Supplement Plan D is one of ten standardized Medigap plans designed to help cover the out-of-pocket costs associated with Original Medicare.

Medigap Plan G is one of several Medicare Supplement plans. These plans, historically known as Medicare Supplements or Secondary Plans, have evolved over time. They are designed to complement Original Medicare (Parts A and B) by covering some of the out-of-pocket costs associated with these programs.

Medigap Plan G

Medigap Plan K

Medicare Supplement Plan K offers coverage for the Medicare Part A hospital deductible and 50% of Medicare Part A and Part B coinsurance and copayment costs.

Medicare Supplement Plan L offers a unique feature: an annual out-of-pocket limit of $3,470 (for 2023). Once you reach this limit, the plan covers 100% of your remaining costs for covered services. This, combined with its lower premiums, makes Plan L an attractive option for many Medicare beneficiaries.

Medigap Plan L

Medigap Plan M

Medicare Supplement Plan M offers similar coverage to other Medigap plans, but at a lower premium. However, with Plan M, you'll be responsible for paying a portion of your Medicare Part A and Part B deductibles.

Medicare Supplement Plan N offers lower premiums by requiring you to pay a portion of your Medicare Part B deductible, excess charges, and some copayments for doctor visits and emergency room services.

Medigap Plan N

Frequently Asked Questions

New to Medicare?

What is Medicare and How Do I Qualify?

Medicare Advantage plans are offered by private insurance companies contracted through Medicare as an alternative to Original Medicare. These plans combine all of the benefits of Medicare Part A (hospital) and Part B (medical), and may also include prescription drug coverage, if they are Medicare Advantage Prescription Drug Plans.These plans combine all of the benefits of Medicare Part A (hospital) and Part B (medical), and may also include prescription drug coverage, dental or vision coverage all for an affordable and sometimes $0 monthly plan premium.

What is Medicare Advantage (Part C)?

Medicare Advantage plans are offered by private insurance companies contracted through Medicare as an alternative to Original Medicare. These plans combine all of the benefits of Medicare Part A (hospital) and Part B (medical), and may also include prescription drug coverage, if they are Medicare Advantage Prescription Drug Plans. These plans combine all of the benefits of Medicare Part A (hospital) and Part B (medical), and may also include prescription drug coverage, dental or vision coverage all for an affordable and sometimes $0 monthly plan premium.

What are Medicare Prescription Drug Plans (Part D)?

Medicare Part D plans add prescription drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service (PFFS) Plans, and Medicare Medical Savings Account (MSA) Plans. A prescription drug plan may help you save money on existing prescriptions or on medication needs in the future.

Not affiliated with the United States government or federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

© 2022 Topflight Insurance Solutions LLC - All Rights Reserved